All Categories

Featured

Table of Contents

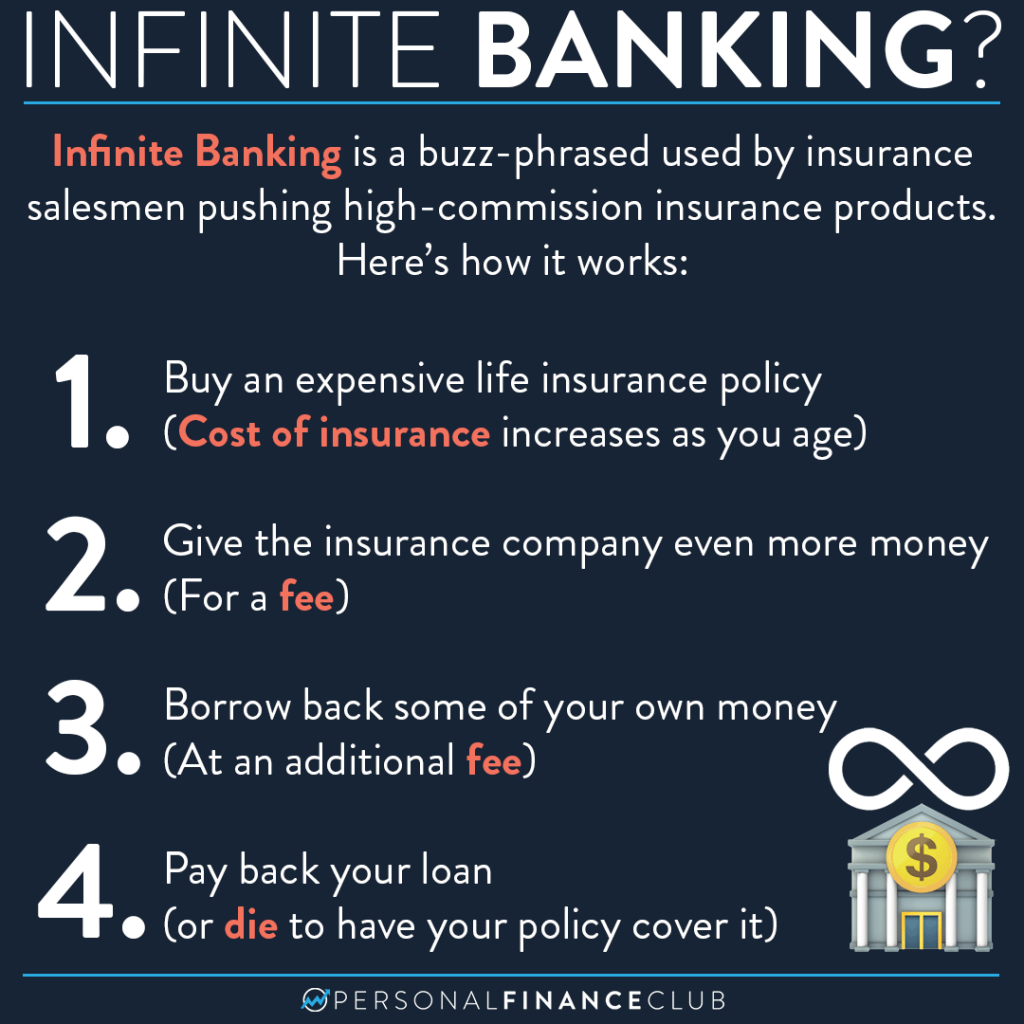

The approach has its own benefits, but it also has problems with high charges, intricacy, and extra, causing it being concerned as a fraud by some. Limitless banking is not the very best policy if you require just the financial investment element. The unlimited banking concept rotates around the use of entire life insurance plans as a financial tool.

A PUAR allows you to "overfund" your insurance coverage right as much as line of it coming to be a Customized Endowment Contract (MEC). When you use a PUAR, you swiftly increase your cash worth (and your survivor benefit), consequently boosting the power of your "bank". Further, the more money value you have, the better your rate of interest and reward repayments from your insurer will certainly be.

With the surge of TikTok as an information-sharing system, economic guidance and methods have located a novel method of dispersing. One such approach that has actually been making the rounds is the boundless banking concept, or IBC for short, garnering recommendations from celebs like rap artist Waka Flocka Fire - Infinite Banking for retirement. Nonetheless, while the approach is presently popular, its origins trace back to the 1980s when economist Nelson Nash presented it to the world.

What resources do I need to succeed with Infinite Banking Wealth Strategy?

Within these plans, the money value expands based on a price set by the insurer. As soon as a significant cash money value gathers, insurance holders can acquire a cash money value finance. These financings differ from traditional ones, with life insurance policy acting as collateral, meaning one could shed their coverage if borrowing exceedingly without sufficient money worth to support the insurance coverage expenses.

And while the attraction of these policies appears, there are natural limitations and threats, demanding persistent cash worth tracking. The method's authenticity isn't black and white. For high-net-worth people or entrepreneur, specifically those utilizing methods like company-owned life insurance coverage (COLI), the benefits of tax obligation breaks and compound growth can be appealing.

The allure of limitless banking does not negate its challenges: Cost: The fundamental need, a long-term life insurance policy, is more expensive than its term equivalents. Eligibility: Not everybody qualifies for entire life insurance policy as a result of rigorous underwriting procedures that can omit those with particular wellness or way of living conditions. Complexity and threat: The elaborate nature of IBC, coupled with its threats, might hinder many, particularly when less complex and less dangerous alternatives are available.

What is Self-financing With Life Insurance?

Allocating around 10% of your regular monthly revenue to the plan is just not possible for a lot of people. Part of what you review below is merely a reiteration of what has actually already been stated above.

Before you obtain yourself into a scenario you're not prepared for, understand the complying with initially: Although the concept is generally sold as such, you're not really taking a funding from on your own. If that were the instance, you wouldn't need to settle it. Rather, you're borrowing from the insurance company and have to repay it with rate of interest.

Some social media articles recommend using money worth from whole life insurance coverage to pay for charge card financial debt. The idea is that when you pay back the lending with passion, the quantity will certainly be sent out back to your financial investments. That's not exactly how it functions. When you repay the funding, a section of that rate of interest mosts likely to the insurer.

What happens if I stop using Infinite Banking For Financial Freedom?

For the very first several years, you'll be repaying the commission. This makes it very tough for your policy to gather value throughout this time. Entire life insurance policy expenses 5 to 15 times more than term insurance coverage. The majority of people merely can not manage it. So, unless you can pay for to pay a couple of to numerous hundred bucks for the next decade or even more, IBC won't function for you.

Not everyone should depend entirely on themselves for monetary safety and security. Financial leverage with Infinite Banking. If you require life insurance policy, below are some valuable suggestions to consider: Consider term life insurance policy. These policies give coverage during years with considerable financial obligations, like mortgages, pupil finances, or when caring for children. See to it to search for the finest price.

Is Infinite Wealth Strategy a good strategy for generational wealth?

Think of never needing to bother with financial institution car loans or high rates of interest once again. Suppose you could obtain money on your terms and construct wide range all at once? That's the power of unlimited banking life insurance policy. By leveraging the cash money worth of entire life insurance IUL policies, you can expand your riches and obtain cash without relying on conventional banks.

There's no set funding term, and you have the liberty to select the payment timetable, which can be as leisurely as repaying the financing at the time of death. This flexibility extends to the servicing of the financings, where you can go with interest-only payments, maintaining the loan balance level and manageable.

What are the risks of using Privatized Banking System?

Holding cash in an IUL fixed account being attributed passion can usually be much better than holding the money on deposit at a bank.: You've constantly desired for opening your own bakeshop. You can borrow from your IUL policy to cover the preliminary costs of leasing a space, acquiring tools, and working with team.

Individual fundings can be acquired from standard financial institutions and cooperative credit union. Here are some bottom lines to consider. Charge card can offer a flexible method to borrow cash for really temporary periods. Obtaining cash on a credit scores card is typically extremely costly with annual percentage rates of interest (APR) frequently getting to 20% to 30% or even more a year.

Table of Contents

Latest Posts

Who can help me set up Financial Leverage With Infinite Banking?

How do I track my growth with Whole Life For Infinite Banking?

How can Leverage Life Insurance reduce my reliance on banks?

More

Latest Posts

Who can help me set up Financial Leverage With Infinite Banking?

How do I track my growth with Whole Life For Infinite Banking?

How can Leverage Life Insurance reduce my reliance on banks?