All Categories

Featured

Table of Contents

The method has its very own benefits, but it additionally has issues with high costs, complexity, and more, resulting in it being regarded as a scam by some. Limitless financial is not the finest policy if you need just the financial investment part. The boundless banking concept revolves around using whole life insurance plans as a monetary device.

A PUAR allows you to "overfund" your insurance coverage plan right as much as line of it becoming a Changed Endowment Contract (MEC). When you use a PUAR, you swiftly increase your cash money worth (and your fatality advantage), consequently increasing the power of your "bank". Better, the even more cash money worth you have, the better your rate of interest and dividend repayments from your insurer will certainly be.

With the increase of TikTok as an information-sharing platform, monetary recommendations and approaches have found an unique way of dispersing. One such technique that has been making the rounds is the infinite financial principle, or IBC for brief, garnering recommendations from celebrities like rap artist Waka Flocka Flame - Infinite Banking. However, while the approach is presently popular, its origins trace back to the 1980s when economist Nelson Nash presented it to the world.

Tax-free Income With Infinite Banking

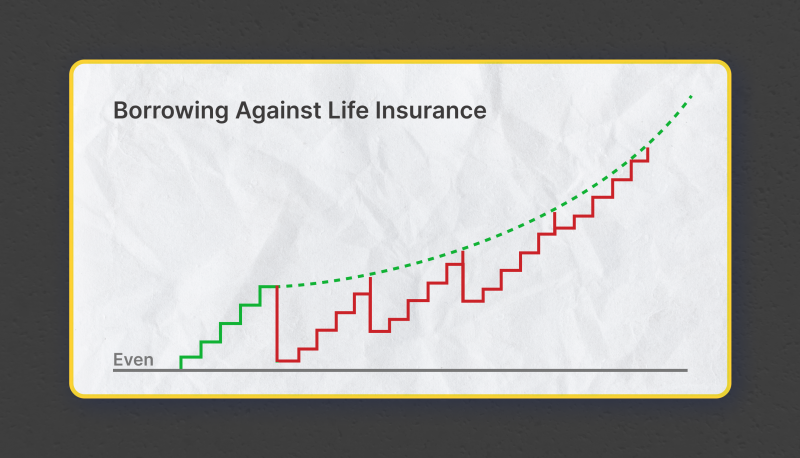

Within these policies, the cash worth grows based on a price established by the insurance company. Once a substantial cash money value gathers, insurance holders can obtain a cash worth financing. These loans differ from traditional ones, with life insurance policy offering as security, suggesting one might shed their insurance coverage if borrowing exceedingly without sufficient cash worth to support the insurance policy expenses.

And while the appeal of these policies appears, there are natural limitations and risks, necessitating attentive cash money worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, particularly those utilizing approaches like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth can be appealing.

The attraction of limitless financial doesn't negate its difficulties: Expense: The foundational demand, a long-term life insurance policy policy, is more expensive than its term equivalents. Eligibility: Not every person gets approved for entire life insurance policy due to strenuous underwriting procedures that can leave out those with certain wellness or way of living problems. Complexity and danger: The intricate nature of IBC, coupled with its risks, might discourage several, particularly when easier and less high-risk choices are readily available.

Infinite Banking For Financial Freedom

Allocating around 10% of your month-to-month income to the plan is simply not viable for the majority of people. Making use of life insurance coverage as an investment and liquidity source requires discipline and tracking of policy cash money worth. Seek advice from an economic advisor to identify if limitless banking lines up with your top priorities. Component of what you review below is just a reiteration of what has currently been claimed above.

Prior to you get on your own into a situation you're not prepared for, know the adhering to first: Although the concept is typically offered as such, you're not really taking a loan from on your own. If that held true, you wouldn't have to repay it. Instead, you're borrowing from the insurance coverage firm and have to repay it with passion.

Some social media articles advise using cash worth from whole life insurance coverage to pay down credit scores card debt. When you pay back the loan, a section of that interest goes to the insurance coverage firm.

How do I qualify for Infinite Banking Benefits?

For the initial a number of years, you'll be paying off the commission. This makes it extremely hard for your plan to collect worth during this time. Unless you can afford to pay a few to numerous hundred dollars for the next years or more, IBC won't function for you.

Not every person ought to depend only on themselves for financial protection. Private banking strategies. If you require life insurance, right here are some important suggestions to think about: Consider term life insurance coverage. These policies offer coverage during years with substantial monetary obligations, like home loans, student car loans, or when caring for children. Make certain to look around for the ideal rate.

How can Infinite Banking reduce my reliance on banks?

Envision never ever having to fret about financial institution fundings or high passion prices once again. What happens if you could obtain cash on your terms and develop wealth at the same time? That's the power of infinite banking life insurance. By leveraging the cash value of entire life insurance coverage IUL plans, you can expand your riches and obtain cash without depending on conventional financial institutions.

There's no collection finance term, and you have the flexibility to select the payment schedule, which can be as leisurely as settling the lending at the time of fatality. This adaptability reaches the maintenance of the loans, where you can go with interest-only settlements, maintaining the lending balance level and convenient.

Can I use Infinite Banking Vs Traditional Banking for my business finances?

Holding money in an IUL taken care of account being attributed rate of interest can usually be better than holding the cash money on down payment at a bank.: You've constantly imagined opening your own bakery. You can borrow from your IUL policy to cover the first expenditures of leasing a room, buying devices, and hiring staff.

Individual fundings can be acquired from standard financial institutions and credit scores unions. Borrowing money on a credit card is usually really pricey with yearly percentage rates of rate of interest (APR) usually reaching 20% to 30% or even more a year.

Latest Posts

Infinite Banking Concept Review

Be Your Own Bank Series

How Does Bank On Yourself Work